User blogs

Tag Search

Tag search results for: "fca regulated forex brokers"

SCAM forex brokers

Forex daily turnover exceeds $5 trillion. The majority of brokers, operating in this market earn their money honestly, by providing financial services to the traders. However, the big money also attracts scam brokers to the industry. These companies only have one target – to quickly collect as much money as possible from the traders and disappear.To get more news about blacklist of forex scam brokers, you can visit wikifx.com official website.

Although scam forex brokers have become a much rarer case than a decade ago, the phenomenon hasn’t disappeared. Forex-Up has been collecting information about fraudulent brokers regularly over the span of several years, putting them on the broker blacklist that you can see below.

Also, below you will find extremely useful and practical information from our top expert Nikolai Peskov, who will tell you how to avoid scam brokers and keep your money safe. He prepared a test for detecting a scam and gave several important recommendations on how to search for the trustworthy brokers.

This type of scam forex brokers is the popular one as it is the easiest to organize. In reality, this website is certainly not a broker. It is only a cover for publication of information that serves as a hook for attracting customers. The task of the scam is to attract as much traffic as possible to the website within a short period and sell a flashy idea to the novice investors. Usually, there are one or several idea developers behind such projects, while their lifespan varies from several weeks to several months.

Entire criminal organizations can operate under the guise of a Forex broker. They are usually based in one of the developing countries with a low legal culture. They exist much longer than your usual scammer – up to several years. Usually, the marketing department involved in collecting contacts of potential victims and a large multi-language call center to scam them form the backbone of such scam companies.

This type of scam is the hardest to determine, because, at first glance, such companies can conduct the usual business of a Forex broker and even hold a license. Their task is to make the customer fully lose his deposit through the use of scamming tactics or reduction of risk of trading with leverage. Often, this type of activity borders with scam and fact manipulation that leads to losses suffered by the customers.

Naturally, after reading such warnings, you may be concerned for the safety of your funds. There is good news, however. In 2021, scam is rather an unpleasant exception.

To help you to practically fully rule out the option of a scam, we will provide you with a list of suspicious features of a broker and recommendations should you discover any. We have prepared the risk scale to estimate the scam. We used 1-10 scale, where 1 means low risk and 10 – highest. Forex-UP analysts use this methodology for its List of Scam Brokers

In order to help our readers to discover the scam companies faster, Forex-Up regularly updates the broker blacklist. You will find the latest list of scammers on our website.

As soon as our experts discover a new scam Forex broker, it is immediately included in the blacklist. We also attentively review the feedback of the customers, who came across a scam. If the company does not allow to withdraw funds or if it shuts down its operation completely, the readers of the website will be among the first ones to know.

Our blacklist includes fly-by-night companies you are highly advised to stay away from. In the list, you will find the name of the scam company, its website, reviews of the customers and a short list of tricks and promises it uses to attract new victims.

Also, below you will find extremely useful and practical information from our top expert Nikolai Peskov, who will tell you how to avoid scam brokers and keep your money safe. He prepared a test for detecting a scam and gave several important recommendations on how to search for the trustworthy brokers.

This type of scam forex brokers is the popular one as it is the easiest to organize. In reality, this website is certainly not a broker. It is only a cover for publication of information that serves as a hook for attracting customers. The task of the scam is to attract as much traffic as possible to the website within a short period and sell a flashy idea to the novice investors. Usually, there are one or several idea developers behind such projects, while their lifespan varies from several weeks to several months.

Entire criminal organizations can operate under the guise of a Forex broker. They are usually based in one of the developing countries with a low legal culture. They exist much longer than your usual scammer – up to several years. Usually, the marketing department involved in collecting contacts of potential victims and a large multi-language call center to scam them form the backbone of such scam companies.

This type of scam is the hardest to determine, because, at first glance, such companies can conduct the usual business of a Forex broker and even hold a license. Their task is to make the customer fully lose his deposit through the use of scamming tactics or reduction of risk of trading with leverage. Often, this type of activity borders with scam and fact manipulation that leads to losses suffered by the customers.

Naturally, after reading such warnings, you may be concerned for the safety of your funds. There is good news, however. In 2021, scam is rather an unpleasant exception.

To help you to practically fully rule out the option of a scam, we will provide you with a list of suspicious features of a broker and recommendations should you discover any. We have prepared the risk scale to estimate the scam. We used 1-10 scale, where 1 means low risk and 10 – highest. Forex-UP analysts use this methodology for its List of Scam Brokers

In order to help our readers to discover the scam companies faster, Forex-Up regularly updates the broker blacklist. You will find the latest list of scammers on our website.

As soon as our experts discover a new scam Forex broker, it is immediately included in the blacklist. We also attentively review the feedback of the customers, who came across a scam. If the company does not allow to withdraw funds or if it shuts down its operation completely, the readers of the website will be among the first ones to know.

Our blacklist includes fly-by-night companies you are highly advised to stay away from. In the list, you will find the name of the scam company, its website, reviews of the customers and a short list of tricks and promises it uses to attract new victims.

Also, below you will find extremely useful and practical information from our top expert Nikolai Peskov, who will tell you how to avoid scam brokers and keep your money safe. He prepared a test for detecting a scam and gave several important recommendations on how to search for the trustworthy brokers.

This type of scam forex brokers is the popular one as it is the easiest to organize. In reality, this website is certainly not a broker. It is only a cover for publication of information that serves as a hook for attracting customers. The task of the scam is to attract as much traffic as possible to the website within a short period and sell a flashy idea to the novice investors. Usually, there are one or several idea developers behind such projects, while their lifespan varies from several weeks to several months.

Entire criminal organizations can operate under the guise of a Forex broker. They are usually based in one of the developing countries with a low legal culture. They exist much longer than your usual scammer – up to several years. Usually, the marketing department involved in collecting contacts of potential victims and a large multi-language call center to scam them form the backbone of such scam companies.

This type of scam is the hardest to determine, because, at first glance, such companies can conduct the usual business of a Forex broker and even hold a license. Their task is to make the customer fully lose his deposit through the use of scamming tactics or reduction of risk of trading with leverage. Often, this type of activity borders with scam and fact manipulation that leads to losses suffered by the customers.

Naturally, after reading such warnings, you may be concerned for the safety of your funds. There is good news, however. In 2021, scam is rather an unpleasant exception.

To help you to practically fully rule out the option of a scam, we will provide you with a list of suspicious features of a broker and recommendations should you discover any. We have prepared the risk scale to estimate the scam. We used 1-10 scale, where 1 means low risk and 10 – highest. Forex-UP analysts use this methodology for its List of Scam Brokers

In order to help our readers to discover the scam companies faster, Forex-Up regularly updates the broker blacklist. You will find the latest list of scammers on our website.

As soon as our experts discover a new scam Forex broker, it is immediately included in the blacklist. We also attentively review the feedback of the customers, who came across a scam. If the company does not allow to withdraw funds or if it shuts down its operation completely, the readers of the website will be among the first ones to know.

Our blacklist includes fly-by-night companies you are highly advised to stay away from. In the list, you will find the name of the scam company, its website, reviews of the customers and a short list of tricks and promises it uses to attract new victims.

Also, below you will find extremely useful and practical information from our top expert Nikolai Peskov, who will tell you how to avoid scam brokers and keep your money safe. He prepared a test for detecting a scam and gave several important recommendations on how to search for the trustworthy brokers.

This type of scam forex brokers is the popular one as it is the easiest to organize. In reality, this website is certainly not a broker. It is only a cover for publication of information that serves as a hook for attracting customers. The task of the scam is to attract as much traffic as possible to the website within a short period and sell a flashy idea to the novice investors. Usually, there are one or several idea developers behind such projects, while their lifespan varies from several weeks to several months.

Entire criminal organizations can operate under the guise of a Forex broker. They are usually based in one of the developing countries with a low legal culture. They exist much longer than your usual scammer – up to several years. Usually, the marketing department involved in collecting contacts of potential victims and a large multi-language call center to scam them form the backbone of such scam companies.

This type of scam is the hardest to determine, because, at first glance, such companies can conduct the usual business of a Forex broker and even hold a license. Their task is to make the customer fully lose his deposit through the use of scamming tactics or reduction of risk of trading with leverage. Often, this type of activity borders with scam and fact manipulation that leads to losses suffered by the customers.

Naturally, after reading such warnings, you may be concerned for the safety of your funds. There is good news, however. In 2021, scam is rather an unpleasant exception.

To help you to practically fully rule out the option of a scam, we will provide you with a list of suspicious features of a broker and recommendations should you discover any. We have prepared the risk scale to estimate the scam. We used 1-10 scale, where 1 means low risk and 10 – highest. Forex-UP analysts use this methodology for its List of Scam Brokers

In order to help our readers to discover the scam companies faster, Forex-Up regularly updates the broker blacklist. You will find the latest list of scammers on our website.

As soon as our experts discover a new scam Forex broker, it is immediately included in the blacklist. We also attentively review the feedback of the customers, who came across a scam. If the company does not allow to withdraw funds or if it shuts down its operation completely, the readers of the website will be among the first ones to know.

Our blacklist includes fly-by-night companies you are highly advised to stay away from. In the list, you will find the name of the scam company, its website, reviews of the customers and a short list of tricks and promises it uses to attract new victims.

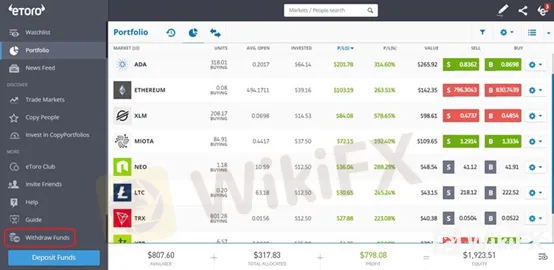

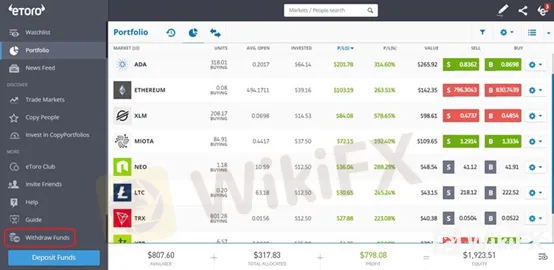

Top Forex Trading Apps

Traders all around the world are benefiting from their successes in the Forex market. However, it's not an easy market to conquer - traders have to keep up with the latest developments, news and events in the financial world. In recent years it has become easier with the increased use of mobile devices, and the development of Forex trading apps, like the MetaTrader 4 app.To get more news about best forex brokers in the world, you can visit wikifx.com official website.

Professional traders no longer have to stay chained to a desk, because Forex trading is now easier than ever to perform from almost any location in the world. This is because any platforms and brokers are offering real-time trading through mobile apps, like the MetaTrader 4 app for pc and mobile device. Forex mobile trading is more important than ever before in this world of 24/7 trading, and 24/7 news cycles.

So, if you're looking for a Forex trading practice app, a Forex news app, an Admirals Forex app or the best Forex trading app in the UK, USA or elsewhere, this Forex app review will assist you in choosing the best Forex broker mobile app for yourself so that you can trade FX anytime, anywhere in the UK or elsewhere.

What are Forex trading apps? Does Forex have an app?

Finding one of the best Forex trading apps for yourself is an important component for trading. Without one, you can't make trades online.

A Forex trading app is a mobile app that allows you to trade the Forex market or provides information that can help you make more informed trading decisions.

These apps may range from the mobile versions of popular trading platforms such as MetaTrader 5 and MetaTrader 4 on the App Store and for Android, to apps designed for a single purpose, like reporting on market news or gamifying the trading experience.

When used together, many apps can create a complete trading toolbox, meaning you can carry out your trading strategy without being chained to your desk.

How to use a trading app?

Perhaps you've wondered how to use a trading app. If so, you're in the right place. How you use a currency trading app will vary depending on the app you use.

Here we'll give you a brief overview of how to trade on one of the most popular mobile trading apps on the market - the MetaTrader 5 app. This will give you a basic understanding of how some of the top mobile Forex trading platforms work.

Once it is installed, you will need to log in to an existing trading account with your account number and password. Don't have an account? Find out how to open one here.

In the MetaTrader 5 app, the available screens are the quote screen, the chart screen, the trade screen, the history screen, and the settings screen.

The quote screen shows the ask and bid prices, or buy and sell prices of your chosen instruments. To add a new instrument to the list, just click the plus icon at the top of the screen, and find the instrument in the list.

Selecting an instrument in the list will give you the options to trade, see the chart, as well as get more details.

The chart screen displays the chart for your chosen instrument. You can change the chart's time frame by clicking the time frame in the top left corner of the screen.

You can add objects and indicators to the chart using the options across the top of the screen.

And you can see the sell and buy prices by clicking the icon at the top right of the screen. You can click on the buy or sell panels to open a trade, and you can adjust the lot size using the dropdown list between these panels.

The trade screen lists any open trades, along with your account balance, equity and free margin.

You can open a trade from this screen by clicking the plus icon. This will open a new screen, where you can select your preferred instrument, select the lot size, and add a stop loss and take profit.

To open a trade, click 'sell by market' if you think the price of the instrument will go down, or 'buy by market' if you think the price will increase.

The history screen displays the trades you've made on your account, and your total earnings or losses. You can update the time period for which trades are displayed by clicking the clock icon in the top right corner of the screen.

Finally, the settings screen is where you can sign into different accounts, along with checking announcements in your trading mailbox, market news, and connecting with the MQL5 community.

So, if you're looking for a Forex trading practice app, a Forex news app, an Admirals Forex app or the best Forex trading app in the UK, USA or elsewhere, this Forex app review will assist you in choosing the best Forex broker mobile app for yourself so that you can trade FX anytime, anywhere in the UK or elsewhere.

What are Forex trading apps? Does Forex have an app?

Finding one of the best Forex trading apps for yourself is an important component for trading. Without one, you can't make trades online.

A Forex trading app is a mobile app that allows you to trade the Forex market or provides information that can help you make more informed trading decisions.

These apps may range from the mobile versions of popular trading platforms such as MetaTrader 5 and MetaTrader 4 on the App Store and for Android, to apps designed for a single purpose, like reporting on market news or gamifying the trading experience.

When used together, many apps can create a complete trading toolbox, meaning you can carry out your trading strategy without being chained to your desk.

How to use a trading app?

Perhaps you've wondered how to use a trading app. If so, you're in the right place. How you use a currency trading app will vary depending on the app you use.

Here we'll give you a brief overview of how to trade on one of the most popular mobile trading apps on the market - the MetaTrader 5 app. This will give you a basic understanding of how some of the top mobile Forex trading platforms work.

Once it is installed, you will need to log in to an existing trading account with your account number and password. Don't have an account? Find out how to open one here.

In the MetaTrader 5 app, the available screens are the quote screen, the chart screen, the trade screen, the history screen, and the settings screen.

The quote screen shows the ask and bid prices, or buy and sell prices of your chosen instruments. To add a new instrument to the list, just click the plus icon at the top of the screen, and find the instrument in the list.

Selecting an instrument in the list will give you the options to trade, see the chart, as well as get more details.

The chart screen displays the chart for your chosen instrument. You can change the chart's time frame by clicking the time frame in the top left corner of the screen.

You can add objects and indicators to the chart using the options across the top of the screen.

And you can see the sell and buy prices by clicking the icon at the top right of the screen. You can click on the buy or sell panels to open a trade, and you can adjust the lot size using the dropdown list between these panels.

The trade screen lists any open trades, along with your account balance, equity and free margin.

You can open a trade from this screen by clicking the plus icon. This will open a new screen, where you can select your preferred instrument, select the lot size, and add a stop loss and take profit.

To open a trade, click 'sell by market' if you think the price of the instrument will go down, or 'buy by market' if you think the price will increase.

The history screen displays the trades you've made on your account, and your total earnings or losses. You can update the time period for which trades are displayed by clicking the clock icon in the top right corner of the screen.

Finally, the settings screen is where you can sign into different accounts, along with checking announcements in your trading mailbox, market news, and connecting with the MQL5 community.

So, if you're looking for a Forex trading practice app, a Forex news app, an Admirals Forex app or the best Forex trading app in the UK, USA or elsewhere, this Forex app review will assist you in choosing the best Forex broker mobile app for yourself so that you can trade FX anytime, anywhere in the UK or elsewhere.

What are Forex trading apps? Does Forex have an app?

Finding one of the best Forex trading apps for yourself is an important component for trading. Without one, you can't make trades online.

A Forex trading app is a mobile app that allows you to trade the Forex market or provides information that can help you make more informed trading decisions.

These apps may range from the mobile versions of popular trading platforms such as MetaTrader 5 and MetaTrader 4 on the App Store and for Android, to apps designed for a single purpose, like reporting on market news or gamifying the trading experience.

When used together, many apps can create a complete trading toolbox, meaning you can carry out your trading strategy without being chained to your desk.

How to use a trading app?

Perhaps you've wondered how to use a trading app. If so, you're in the right place. How you use a currency trading app will vary depending on the app you use.

Here we'll give you a brief overview of how to trade on one of the most popular mobile trading apps on the market - the MetaTrader 5 app. This will give you a basic understanding of how some of the top mobile Forex trading platforms work.

Once it is installed, you will need to log in to an existing trading account with your account number and password. Don't have an account? Find out how to open one here.

In the MetaTrader 5 app, the available screens are the quote screen, the chart screen, the trade screen, the history screen, and the settings screen.

The quote screen shows the ask and bid prices, or buy and sell prices of your chosen instruments. To add a new instrument to the list, just click the plus icon at the top of the screen, and find the instrument in the list.

Selecting an instrument in the list will give you the options to trade, see the chart, as well as get more details.

The chart screen displays the chart for your chosen instrument. You can change the chart's time frame by clicking the time frame in the top left corner of the screen.

You can add objects and indicators to the chart using the options across the top of the screen.

And you can see the sell and buy prices by clicking the icon at the top right of the screen. You can click on the buy or sell panels to open a trade, and you can adjust the lot size using the dropdown list between these panels.

The trade screen lists any open trades, along with your account balance, equity and free margin.

You can open a trade from this screen by clicking the plus icon. This will open a new screen, where you can select your preferred instrument, select the lot size, and add a stop loss and take profit.

To open a trade, click 'sell by market' if you think the price of the instrument will go down, or 'buy by market' if you think the price will increase.

The history screen displays the trades you've made on your account, and your total earnings or losses. You can update the time period for which trades are displayed by clicking the clock icon in the top right corner of the screen.

Finally, the settings screen is where you can sign into different accounts, along with checking announcements in your trading mailbox, market news, and connecting with the MQL5 community.

So, if you're looking for a Forex trading practice app, a Forex news app, an Admirals Forex app or the best Forex trading app in the UK, USA or elsewhere, this Forex app review will assist you in choosing the best Forex broker mobile app for yourself so that you can trade FX anytime, anywhere in the UK or elsewhere.

What are Forex trading apps? Does Forex have an app?

Finding one of the best Forex trading apps for yourself is an important component for trading. Without one, you can't make trades online.

A Forex trading app is a mobile app that allows you to trade the Forex market or provides information that can help you make more informed trading decisions.

These apps may range from the mobile versions of popular trading platforms such as MetaTrader 5 and MetaTrader 4 on the App Store and for Android, to apps designed for a single purpose, like reporting on market news or gamifying the trading experience.

When used together, many apps can create a complete trading toolbox, meaning you can carry out your trading strategy without being chained to your desk.

How to use a trading app?

Perhaps you've wondered how to use a trading app. If so, you're in the right place. How you use a currency trading app will vary depending on the app you use.

Here we'll give you a brief overview of how to trade on one of the most popular mobile trading apps on the market - the MetaTrader 5 app. This will give you a basic understanding of how some of the top mobile Forex trading platforms work.

Once it is installed, you will need to log in to an existing trading account with your account number and password. Don't have an account? Find out how to open one here.

In the MetaTrader 5 app, the available screens are the quote screen, the chart screen, the trade screen, the history screen, and the settings screen.

The quote screen shows the ask and bid prices, or buy and sell prices of your chosen instruments. To add a new instrument to the list, just click the plus icon at the top of the screen, and find the instrument in the list.

Selecting an instrument in the list will give you the options to trade, see the chart, as well as get more details.

The chart screen displays the chart for your chosen instrument. You can change the chart's time frame by clicking the time frame in the top left corner of the screen.

You can add objects and indicators to the chart using the options across the top of the screen.

And you can see the sell and buy prices by clicking the icon at the top right of the screen. You can click on the buy or sell panels to open a trade, and you can adjust the lot size using the dropdown list between these panels.

The trade screen lists any open trades, along with your account balance, equity and free margin.

You can open a trade from this screen by clicking the plus icon. This will open a new screen, where you can select your preferred instrument, select the lot size, and add a stop loss and take profit.

To open a trade, click 'sell by market' if you think the price of the instrument will go down, or 'buy by market' if you think the price will increase.

The history screen displays the trades you've made on your account, and your total earnings or losses. You can update the time period for which trades are displayed by clicking the clock icon in the top right corner of the screen.

Finally, the settings screen is where you can sign into different accounts, along with checking announcements in your trading mailbox, market news, and connecting with the MQL5 community. Standard Chartered Appointed Cash Management Partner

Standard Chartered Bank (the “Bank”) has been appointed as OANDA’s cash management bank for payments and collections in the United States and United Kingdom; an extension of an existing relationship covering the Singapore market. The Bank has also been mandated as OANDA’s foreign exchange (FX) prime broker for its retail FX business internationally.To get more news about scb regulated forex brokers, you can visit wikifx.com official website.

Through this mandate, OANDA will be able to manage its payments and collections through streamlined Cloud-based processing services across various geographies via the Bank’s Straight2Bank platform.

With Cloud-based payment processing solutions such as Automated Clearing House (ACH) in the United States, OANDA will be able to improve its speed to market through faster service enhancements and the potential to apply new payments schemes reliably and securely.

“Standard Chartered’s ability to offer a one stop Cloud-based solution that encompasses foreign exchange, prime brokerage, payments, collections, and FX hedging is aligned with our mission to efficiently support our retail and corporate clients across the globe,” says Gavin Bambury, Chief Executive Officer of OANDA. “We look forward to the continued partnership and the opportunity to bank with them across different markets.”

“This mandate is a wonderful demonstration of our ability to offer international clients with localized and regional solutions that support their growth ambitions,” said Karen Hom, Managing Director of Transaction Banking at Standard Chartered Americas. “As treasury teams seek flexible and seamless processing experiences, Cloud-based payment solutions will offer forward looking companies like OANDA the opportunity to scale and grow efficiently.”

About OANDA

Founded in 1996, OANDA was the first company to share exchange rate data free of charge on the Internet, launching an FX trading platform that helped pioneer the development of web-based currency trading five years later. Today, the OANDA group, which includes OANDA Corporation, OANDA Europe Limited, OANDA Asia Pacific Pte Ltd and other subsidiaries of OANDA Global Corporation, provides online multi-asset trading, currency data and analytics to retail and corporate clients around the globe, demonstrating an unrivaled expertise in foreign exchange. With regulated entities in nine of the world’s most active financial markets, OANDA remains dedicated to transforming how the world interacts with trading, enabling clients to trade global market indices, commodities, treasuries, precious metals and currencies on one of the fastest trading platforms in the market.

About Standard Chartered

We are a leading international banking group, with a presence in 59 of the world’s most dynamic markets, and serving clients in a further 83. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, here for good.

Our history in the US dates back to 1902, and we are currently present in eight locations throughout the Americas. Our Americas franchise focuses on financial institutions and select corporates and plays a key role in facilitating trade and investment flows between the Americas and Asia, Africa, and the Middle East.

“Standard Chartered’s ability to offer a one stop Cloud-based solution that encompasses foreign exchange, prime brokerage, payments, collections, and FX hedging is aligned with our mission to efficiently support our retail and corporate clients across the globe,” says Gavin Bambury, Chief Executive Officer of OANDA. “We look forward to the continued partnership and the opportunity to bank with them across different markets.”

“This mandate is a wonderful demonstration of our ability to offer international clients with localized and regional solutions that support their growth ambitions,” said Karen Hom, Managing Director of Transaction Banking at Standard Chartered Americas. “As treasury teams seek flexible and seamless processing experiences, Cloud-based payment solutions will offer forward looking companies like OANDA the opportunity to scale and grow efficiently.”

About OANDA

Founded in 1996, OANDA was the first company to share exchange rate data free of charge on the Internet, launching an FX trading platform that helped pioneer the development of web-based currency trading five years later. Today, the OANDA group, which includes OANDA Corporation, OANDA Europe Limited, OANDA Asia Pacific Pte Ltd and other subsidiaries of OANDA Global Corporation, provides online multi-asset trading, currency data and analytics to retail and corporate clients around the globe, demonstrating an unrivaled expertise in foreign exchange. With regulated entities in nine of the world’s most active financial markets, OANDA remains dedicated to transforming how the world interacts with trading, enabling clients to trade global market indices, commodities, treasuries, precious metals and currencies on one of the fastest trading platforms in the market.

About Standard Chartered

We are a leading international banking group, with a presence in 59 of the world’s most dynamic markets, and serving clients in a further 83. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, here for good.

Our history in the US dates back to 1902, and we are currently present in eight locations throughout the Americas. Our Americas franchise focuses on financial institutions and select corporates and plays a key role in facilitating trade and investment flows between the Americas and Asia, Africa, and the Middle East.

“Standard Chartered’s ability to offer a one stop Cloud-based solution that encompasses foreign exchange, prime brokerage, payments, collections, and FX hedging is aligned with our mission to efficiently support our retail and corporate clients across the globe,” says Gavin Bambury, Chief Executive Officer of OANDA. “We look forward to the continued partnership and the opportunity to bank with them across different markets.”

“This mandate is a wonderful demonstration of our ability to offer international clients with localized and regional solutions that support their growth ambitions,” said Karen Hom, Managing Director of Transaction Banking at Standard Chartered Americas. “As treasury teams seek flexible and seamless processing experiences, Cloud-based payment solutions will offer forward looking companies like OANDA the opportunity to scale and grow efficiently.”

About OANDA

Founded in 1996, OANDA was the first company to share exchange rate data free of charge on the Internet, launching an FX trading platform that helped pioneer the development of web-based currency trading five years later. Today, the OANDA group, which includes OANDA Corporation, OANDA Europe Limited, OANDA Asia Pacific Pte Ltd and other subsidiaries of OANDA Global Corporation, provides online multi-asset trading, currency data and analytics to retail and corporate clients around the globe, demonstrating an unrivaled expertise in foreign exchange. With regulated entities in nine of the world’s most active financial markets, OANDA remains dedicated to transforming how the world interacts with trading, enabling clients to trade global market indices, commodities, treasuries, precious metals and currencies on one of the fastest trading platforms in the market.

About Standard Chartered

We are a leading international banking group, with a presence in 59 of the world’s most dynamic markets, and serving clients in a further 83. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, here for good.

Our history in the US dates back to 1902, and we are currently present in eight locations throughout the Americas. Our Americas franchise focuses on financial institutions and select corporates and plays a key role in facilitating trade and investment flows between the Americas and Asia, Africa, and the Middle East.

“Standard Chartered’s ability to offer a one stop Cloud-based solution that encompasses foreign exchange, prime brokerage, payments, collections, and FX hedging is aligned with our mission to efficiently support our retail and corporate clients across the globe,” says Gavin Bambury, Chief Executive Officer of OANDA. “We look forward to the continued partnership and the opportunity to bank with them across different markets.”

“This mandate is a wonderful demonstration of our ability to offer international clients with localized and regional solutions that support their growth ambitions,” said Karen Hom, Managing Director of Transaction Banking at Standard Chartered Americas. “As treasury teams seek flexible and seamless processing experiences, Cloud-based payment solutions will offer forward looking companies like OANDA the opportunity to scale and grow efficiently.”

About OANDA

Founded in 1996, OANDA was the first company to share exchange rate data free of charge on the Internet, launching an FX trading platform that helped pioneer the development of web-based currency trading five years later. Today, the OANDA group, which includes OANDA Corporation, OANDA Europe Limited, OANDA Asia Pacific Pte Ltd and other subsidiaries of OANDA Global Corporation, provides online multi-asset trading, currency data and analytics to retail and corporate clients around the globe, demonstrating an unrivaled expertise in foreign exchange. With regulated entities in nine of the world’s most active financial markets, OANDA remains dedicated to transforming how the world interacts with trading, enabling clients to trade global market indices, commodities, treasuries, precious metals and currencies on one of the fastest trading platforms in the market.

About Standard Chartered

We are a leading international banking group, with a presence in 59 of the world’s most dynamic markets, and serving clients in a further 83. Our purpose is to drive commerce and prosperity through our unique diversity, and our heritage and values are expressed in our brand promise, here for good.

Our history in the US dates back to 1902, and we are currently present in eight locations throughout the Americas. Our Americas franchise focuses on financial institutions and select corporates and plays a key role in facilitating trade and investment flows between the Americas and Asia, Africa, and the Middle East.

9 Best FCA Regulated Forex Brokers 2023

The Financial Conduct Authority (FCA) is the UK’s financial regulator and is renowned as the most stringent regulator of Forex brokers in the world and has a reputation for guaranteeing trader security. All FCA-regulated brokers must segregate client funds, provide negative balance protection, process withdrawals instantaneously, and provide compensation of up to 50,000 GBP to protect traders against broker-related matters. To get more news about fca regulated forex brokers, you can visit wikifx.com official website.

The FCA-regulated brokers below have low trading costs and a good reputation, but each has unique features making them suitable for different types of traders.

Why Trade with an FCA-regulated broker?

The FCA oversees all British firms, Forex brokers, and individuals offering financial services and applies one of the world’s strictest regulatory environments. The FCA also actively enforces compliance with the rules and regulations governing CFD products and consumer protection.

How to compare FCA-regulated brokers

FCA is one of the most respected financial regulatory agencies in the world. They are a very traditional but well-funded organization, making regulatory changes and issuing warnings to protect would-be traders and maintain fairness in the CFD industry. All FCA-regulated brokers can be considered safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When comparing FCA-regulated brokers consider:

Regulation: While your broker is FCA regulated, your trading account may not be. It is increasingly common for FCA-regulated brokers to onboard UK residents onto a different license where trading conditions, like leverage, can be increased without the FCA oversight. While this is not fundamentally bad, a trader should know their trading account is regulated and that FCA will not enforce their regulations in overseas territories. If you value the regulatory oversight of the FCA, don’t trade that for adjusted trading conditions.

Platform choice: Traders have a wide range of industry platforms to choose from, each with pros and cons. When comparing brokers, always consider the platform options, as unique features or a wide variety of platforms could change your trading experience.

Trading costs: Every broker will charge for their services, but each will have different pricing models and costs. While ECN brokers will charge a smaller spread combined with a commission based on volume, market maker brokers will charge a wider spread. We compare brokers by looking at what 1 lot of EURUSD costs to trade and would encourage traders to do the same in comparing costs.

MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

Minimum Deposit: The minimum deposit could change by account type, with higher minimum deposits often linked to better conditions. Always consider the minimum deposit specific to the account type you may open.

Deposit and Withdrawal Methods: Most brokers accept credit cards and bank transfer payment, and many accept online payments through Skrill and Neteller, and some will also accept Bitcoin. Always check the withdrawal fees before making a deposit.

Pepperstone – Best Overall FCA Regulated Broker

Established in 2010 in Australia, Pepperstone entered the UK market in 2016. Pepperstone UK is regulated by the FCA (licence no. 684312) and all client funds are kept in segregated trust accounts at Barclays. As of June 2020, Pepperstone’s UK office had almost 8,000 clients, drawn by Pepperstone’s low fees, its range of UK share CFDs and choice of three popular trading platforms.

Trading Platforms: Pepperstone offers support for three of the most popular trading platforms, including Metatrader 4 (MT4), Metatrader 5 (MT5), and cTrader. Although it was developed in 2002, MT4 is the most widely used cross-broker trading platform available. MT5, the newer version of MT4, has greater functionality and more advanced charting tools, while cTrader has a more intuitive design and is easier for beginners to operate, but offers most of the automated trading tools found on MT4 and MT5.

Low Trading Fees: Pepperstone offers two simple account types with competitive trading fees. The Standard Account has fees included in its variable spreads, which average at 0.84 pips* on the EUR/USD, while the Razor Account offers raw spreads of 0.24 pips in exchange for a round-turn commission of 7 USD. Overall, these are some of the lowest trading fees in the industry.

How to compare FCA-regulated brokers

FCA is one of the most respected financial regulatory agencies in the world. They are a very traditional but well-funded organization, making regulatory changes and issuing warnings to protect would-be traders and maintain fairness in the CFD industry. All FCA-regulated brokers can be considered safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When comparing FCA-regulated brokers consider:

Regulation: While your broker is FCA regulated, your trading account may not be. It is increasingly common for FCA-regulated brokers to onboard UK residents onto a different license where trading conditions, like leverage, can be increased without the FCA oversight. While this is not fundamentally bad, a trader should know their trading account is regulated and that FCA will not enforce their regulations in overseas territories. If you value the regulatory oversight of the FCA, don’t trade that for adjusted trading conditions.

Platform choice: Traders have a wide range of industry platforms to choose from, each with pros and cons. When comparing brokers, always consider the platform options, as unique features or a wide variety of platforms could change your trading experience.

Trading costs: Every broker will charge for their services, but each will have different pricing models and costs. While ECN brokers will charge a smaller spread combined with a commission based on volume, market maker brokers will charge a wider spread. We compare brokers by looking at what 1 lot of EURUSD costs to trade and would encourage traders to do the same in comparing costs.

MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

Minimum Deposit: The minimum deposit could change by account type, with higher minimum deposits often linked to better conditions. Always consider the minimum deposit specific to the account type you may open.

Deposit and Withdrawal Methods: Most brokers accept credit cards and bank transfer payment, and many accept online payments through Skrill and Neteller, and some will also accept Bitcoin. Always check the withdrawal fees before making a deposit.

Pepperstone – Best Overall FCA Regulated Broker

Established in 2010 in Australia, Pepperstone entered the UK market in 2016. Pepperstone UK is regulated by the FCA (licence no. 684312) and all client funds are kept in segregated trust accounts at Barclays. As of June 2020, Pepperstone’s UK office had almost 8,000 clients, drawn by Pepperstone’s low fees, its range of UK share CFDs and choice of three popular trading platforms.

Trading Platforms: Pepperstone offers support for three of the most popular trading platforms, including Metatrader 4 (MT4), Metatrader 5 (MT5), and cTrader. Although it was developed in 2002, MT4 is the most widely used cross-broker trading platform available. MT5, the newer version of MT4, has greater functionality and more advanced charting tools, while cTrader has a more intuitive design and is easier for beginners to operate, but offers most of the automated trading tools found on MT4 and MT5.

Low Trading Fees: Pepperstone offers two simple account types with competitive trading fees. The Standard Account has fees included in its variable spreads, which average at 0.84 pips* on the EUR/USD, while the Razor Account offers raw spreads of 0.24 pips in exchange for a round-turn commission of 7 USD. Overall, these are some of the lowest trading fees in the industry.

How to compare FCA-regulated brokers

FCA is one of the most respected financial regulatory agencies in the world. They are a very traditional but well-funded organization, making regulatory changes and issuing warnings to protect would-be traders and maintain fairness in the CFD industry. All FCA-regulated brokers can be considered safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When comparing FCA-regulated brokers consider:

Regulation: While your broker is FCA regulated, your trading account may not be. It is increasingly common for FCA-regulated brokers to onboard UK residents onto a different license where trading conditions, like leverage, can be increased without the FCA oversight. While this is not fundamentally bad, a trader should know their trading account is regulated and that FCA will not enforce their regulations in overseas territories. If you value the regulatory oversight of the FCA, don’t trade that for adjusted trading conditions.

Platform choice: Traders have a wide range of industry platforms to choose from, each with pros and cons. When comparing brokers, always consider the platform options, as unique features or a wide variety of platforms could change your trading experience.

Trading costs: Every broker will charge for their services, but each will have different pricing models and costs. While ECN brokers will charge a smaller spread combined with a commission based on volume, market maker brokers will charge a wider spread. We compare brokers by looking at what 1 lot of EURUSD costs to trade and would encourage traders to do the same in comparing costs.

MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

Minimum Deposit: The minimum deposit could change by account type, with higher minimum deposits often linked to better conditions. Always consider the minimum deposit specific to the account type you may open.

Deposit and Withdrawal Methods: Most brokers accept credit cards and bank transfer payment, and many accept online payments through Skrill and Neteller, and some will also accept Bitcoin. Always check the withdrawal fees before making a deposit.

Pepperstone – Best Overall FCA Regulated Broker

Established in 2010 in Australia, Pepperstone entered the UK market in 2016. Pepperstone UK is regulated by the FCA (licence no. 684312) and all client funds are kept in segregated trust accounts at Barclays. As of June 2020, Pepperstone’s UK office had almost 8,000 clients, drawn by Pepperstone’s low fees, its range of UK share CFDs and choice of three popular trading platforms.

Trading Platforms: Pepperstone offers support for three of the most popular trading platforms, including Metatrader 4 (MT4), Metatrader 5 (MT5), and cTrader. Although it was developed in 2002, MT4 is the most widely used cross-broker trading platform available. MT5, the newer version of MT4, has greater functionality and more advanced charting tools, while cTrader has a more intuitive design and is easier for beginners to operate, but offers most of the automated trading tools found on MT4 and MT5.

Low Trading Fees: Pepperstone offers two simple account types with competitive trading fees. The Standard Account has fees included in its variable spreads, which average at 0.84 pips* on the EUR/USD, while the Razor Account offers raw spreads of 0.24 pips in exchange for a round-turn commission of 7 USD. Overall, these are some of the lowest trading fees in the industry.

How to compare FCA-regulated brokers

FCA is one of the most respected financial regulatory agencies in the world. They are a very traditional but well-funded organization, making regulatory changes and issuing warnings to protect would-be traders and maintain fairness in the CFD industry. All FCA-regulated brokers can be considered safe due to the strict regulatory environment in which they operate, and most of them are very strong all-round. But it is essential to look at the detail of each broker to find out what differentiates them from each other. When comparing FCA-regulated brokers consider:

Regulation: While your broker is FCA regulated, your trading account may not be. It is increasingly common for FCA-regulated brokers to onboard UK residents onto a different license where trading conditions, like leverage, can be increased without the FCA oversight. While this is not fundamentally bad, a trader should know their trading account is regulated and that FCA will not enforce their regulations in overseas territories. If you value the regulatory oversight of the FCA, don’t trade that for adjusted trading conditions.

Platform choice: Traders have a wide range of industry platforms to choose from, each with pros and cons. When comparing brokers, always consider the platform options, as unique features or a wide variety of platforms could change your trading experience.

Trading costs: Every broker will charge for their services, but each will have different pricing models and costs. While ECN brokers will charge a smaller spread combined with a commission based on volume, market maker brokers will charge a wider spread. We compare brokers by looking at what 1 lot of EURUSD costs to trade and would encourage traders to do the same in comparing costs.

MetaTrader 4 is still the industry standard, but many brokers offer MetaTrader 5 and their proprietary platforms. ECN/STP brokers will often support cTrader as it is built specifically for market execution and only allows for minimal broker interference.

Minimum Deposit: The minimum deposit could change by account type, with higher minimum deposits often linked to better conditions. Always consider the minimum deposit specific to the account type you may open.

Deposit and Withdrawal Methods: Most brokers accept credit cards and bank transfer payment, and many accept online payments through Skrill and Neteller, and some will also accept Bitcoin. Always check the withdrawal fees before making a deposit.

Pepperstone – Best Overall FCA Regulated Broker

Established in 2010 in Australia, Pepperstone entered the UK market in 2016. Pepperstone UK is regulated by the FCA (licence no. 684312) and all client funds are kept in segregated trust accounts at Barclays. As of June 2020, Pepperstone’s UK office had almost 8,000 clients, drawn by Pepperstone’s low fees, its range of UK share CFDs and choice of three popular trading platforms.

Trading Platforms: Pepperstone offers support for three of the most popular trading platforms, including Metatrader 4 (MT4), Metatrader 5 (MT5), and cTrader. Although it was developed in 2002, MT4 is the most widely used cross-broker trading platform available. MT5, the newer version of MT4, has greater functionality and more advanced charting tools, while cTrader has a more intuitive design and is easier for beginners to operate, but offers most of the automated trading tools found on MT4 and MT5.

Low Trading Fees: Pepperstone offers two simple account types with competitive trading fees. The Standard Account has fees included in its variable spreads, which average at 0.84 pips* on the EUR/USD, while the Razor Account offers raw spreads of 0.24 pips in exchange for a round-turn commission of 7 USD. Overall, these are some of the lowest trading fees in the industry.